MSU Volunteer Income Tax Assistance

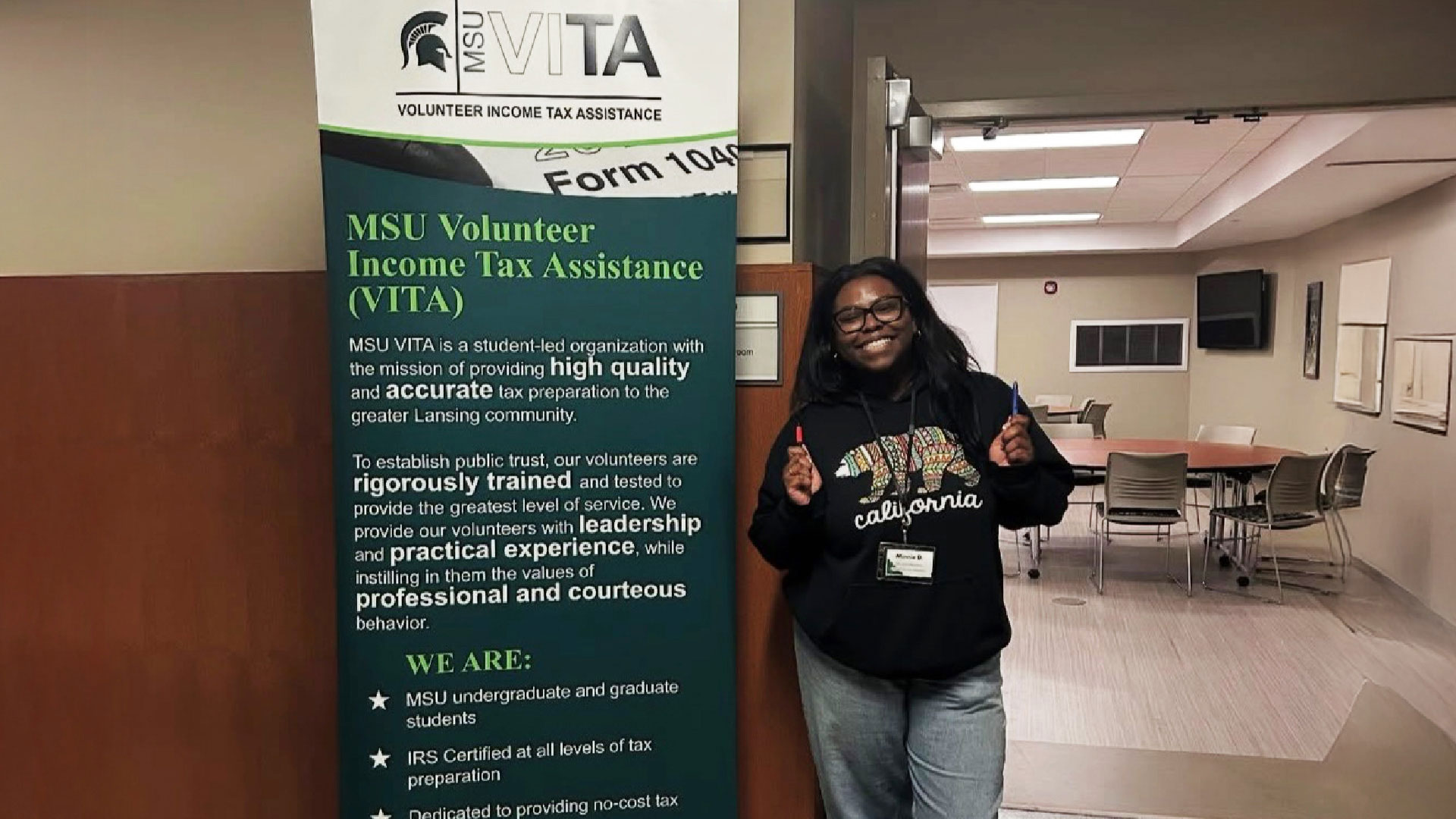

The Michigan State University Volunteer Income Tax Assistance (VITA) program exemplifies the power of community-engaged learning. During the 2024-2025 tax season, 52 MSU students became certified IRS tax preparers and contributed over 926 hours of service, offering free tax preparation to individuals and families across the region.

Hosted on campus, the MSU VITA site provided a welcoming and accessible space for community members to receive support. This work was made possible through a valued partnership with the United Way of South Central Michigan’s Regional VITA Program, whose collaboration ensured quality, consistency, and impact.

The program is co-advised by the Center for Community Engaged Learning (CCEL) and the Broad College of Business, creating a unique interdisciplinary experience that blends technical skill-building with civic responsibility. Students not only gained real-world experience in tax preparation but also deepened their understanding of economic justice and the barriers many face in accessing financial services.

Advised by CCEL Assistant Director Tina Houghton, the VITA team served 147 clients, completing 122 returns—110 of which were filed electronically and 12 by paper. Their efforts helped secure $177,735 in federal refunds, saving clients an estimated $37,332 in tax preparation fees.

Through this work, students engaged in meaningful reflection, built relationships with community members, and contributed to a more equitable financial landscape, demonstrating how learning and service can go hand in hand.